Cheese Makers Reel as Pandemic Sows Market Chaos

By Jesse Newman and Kirk Maltais

Updated Oct. 28, 2020 2:23 pm ET

The U.S. cheese industry is reeling from seven months of chaos as the coronavirus pandemic causes upheaval in prices and demand.

Prices for cheeses from mozzarella to cheddar hit near-record highs this month, but cheese makers are on edge after sharp swings in demand have thrown their production plans into disarray. Those soaring prices have also scrambled planning for buyers from pizza chains to grocery stores, prompting restaurants to limit purchases to avoid getting stuck with expensive inventories if the pandemic slashes business again.

For Errico Auricchio, president of BelGioioso Cheese Inc., a Wisconsin-based cheese maker, plunging demand last spring forced him to shift from making fresh cheeses that can’t be stored, like mozzarella, to hard cheeses like Parmesan, which are aged for up to a year before they are marketed. BelGioioso’s plants filled to the brim with so much unsold cheese that he had to rent extra space to store millions of pounds of Parmesan.

Now, he worries prices will crash. “I wake up at 3 a.m. thinking: ‘How am I going to sell all this Parmesan,’” said Mr. Auricchio.

WSJ NEWSLETTER

Notes on the News

Restaurants nervous about ordering cheese they can’t use are buying products just one month in advance versus their typical approach of booking purchases up to a year early, said Mark Stephenson, director of dairy policy analysis with the University of Wisconsin-Madison.

Executives at Domino’s Pizza Inc. and Little Caesars Pizza said sharp shifts in cheese prices posed challenges for the chains, in some cases boosting costs.

Tim Barr, vice president of supply chain for Marco’s Pizza, a midsize pizza chain based in Toledo, Ohio, said high prices have led his company to seek new, cheaper cheese suppliers. “Cheese is, by far, our highest food cost item,” Mr. Barr said, adding that unprecedented price increases have significantly squeezed margins.

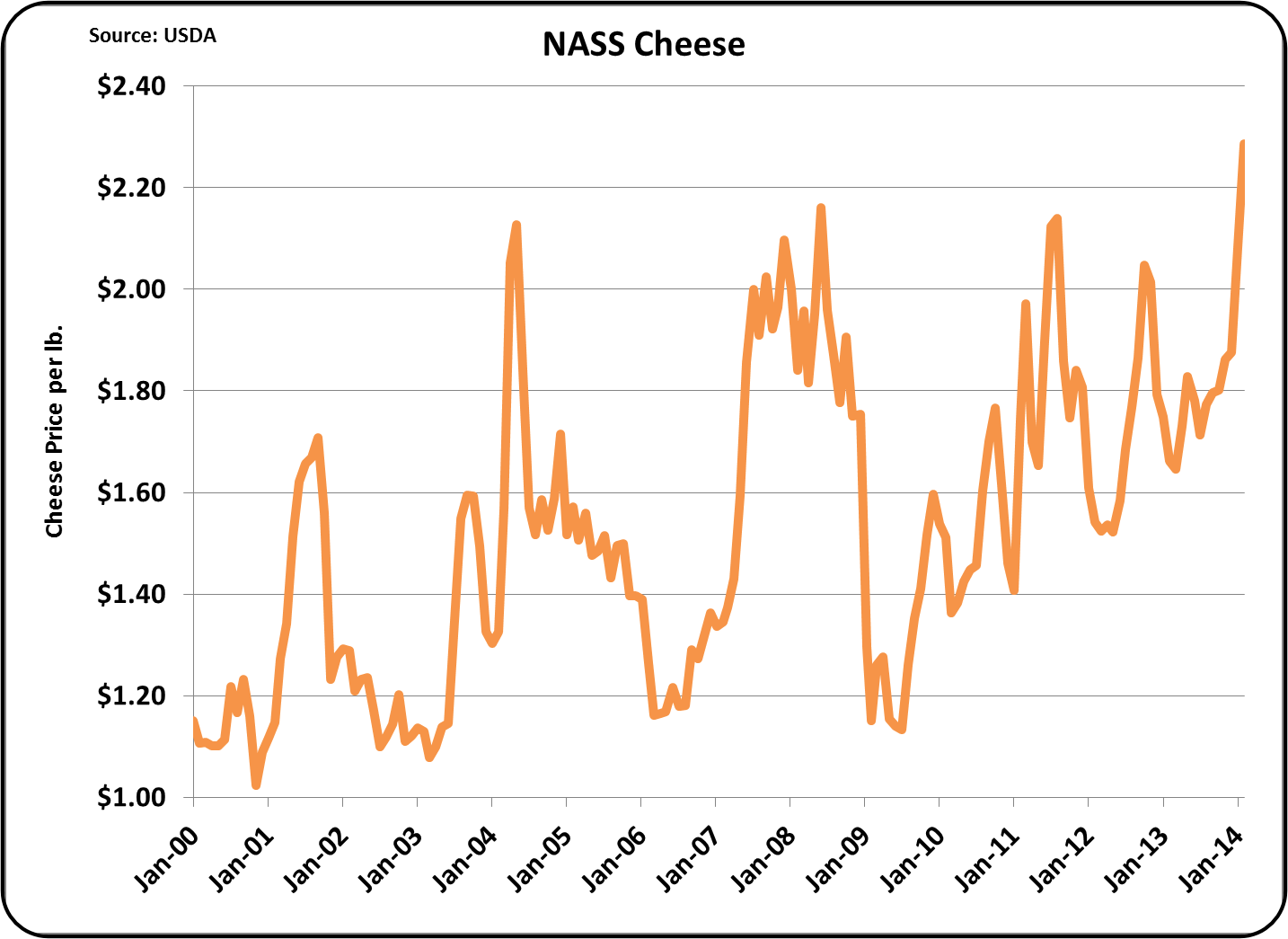

Shredded Block cheese prices swung from 17-year lows to all-time highs in a matter of months Block cheese futures, CME, year-to-date Source: FactSet

per pound Feb. 2020Oct.0.751.001.251.501.752.002.252.502.753.00$3.25

Nationwide restaurant closures at the beginning of the pandemic cratered cheese sales and sent per-pound prices for 40-pound blocks of cheddar, the industry benchmark, to $1, the lowest since 2003. Lots of cheese makers slowed or halted production, helping lead dairy cooperatives that sell farmers’ milk to curb their own output by asking members to dump millions of gallons or cull their herds.

Then the government stepped in. The Trump administration in April announced plans to purchase $3 billion of dairy, meat and produce to be distributed through food banks. The sudden surge in demand lifted cheese prices and prompted Bel Gioioso to ramp up mozzarella production again.

Restaurant cheese purchases also picked up over the summer as eateries pivoted to takeout and delivery and restrictions on in-person dining eased. Pizza sales boomed at large chains and homebound consumers stocked up on vast quantities of cheese at grocery stores. U.S. cheese exports rose too.

Cheddar prices surged to a record $3 per pound in July, making cheese a leader in a broader agricultural-commodity rally. Multiyear highs in futures prices for corn, soybeans, and wheat are offering a reprieve to farmers who have suffered through a prolonged agricultural recession that has driven some out of business.

Though the high prices have been a boon for some cheese makers, the fast shifts in demand have made planning next to impossible, dairy executives say.

“It’s been chaos,” said Jeffrey Schwager, chief executive of Wisconsin-based Sartori Co., which sells cheese to grocers, pizza chains and food manufacturers. “Some weeks we’re literally working seven days a week, running plants 24 hours per day,” he said. “Other days we’re looking for work.”

Before the pandemic, Sartori sold grocers wheels of cheese to slice for customers at deli counters. With delis closed or offering reduced services, grocers now are asking him to prepackage cheese in wedges for individual sale, Mr. Schwager said.